Definition of Invoice

Invoice is a letter made and sent by the seller to the buyer or consumer, because the buyer has not paid its obligations until the agreed time limit. In simple language, the buyer still owes the seller.

The complexity of the billing process is often faced by companies as well. This fairly complicated collection process is handled by the receiving accounts department, or the division that is responsible for managing and managing the company’s finances, including accounts receivable that must be collected.

If calculated from the time limit provided, the buyer does not pay the bill, so the seller can send the next bill. And in the last bill was accompanied by a threat that if the deadline has been determined, the bill has not been paid, then this matter will be brought to court.

Also read: How to make invoices easily

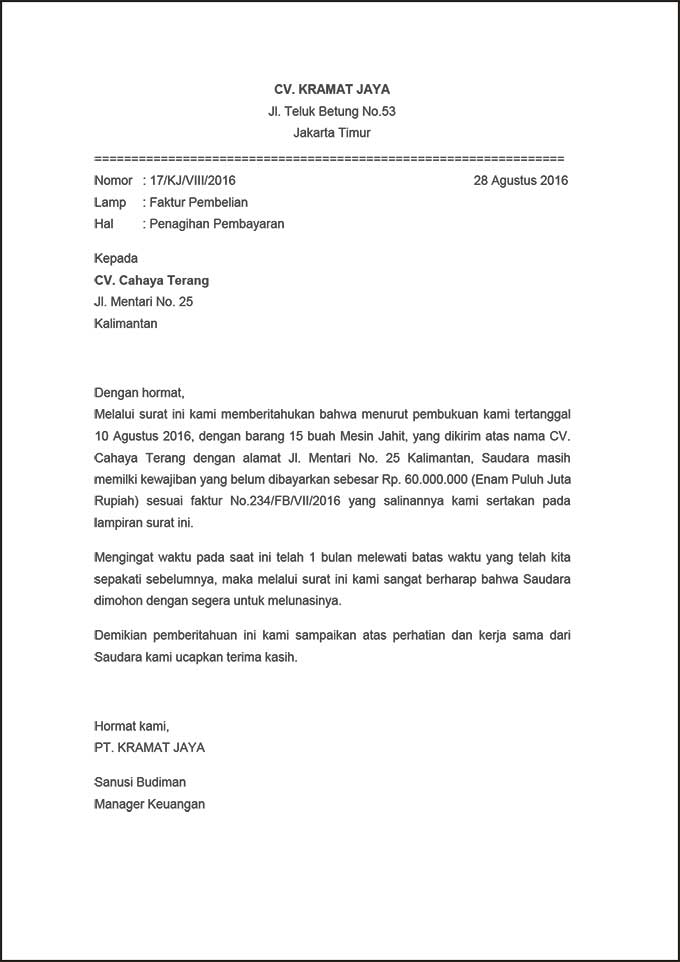

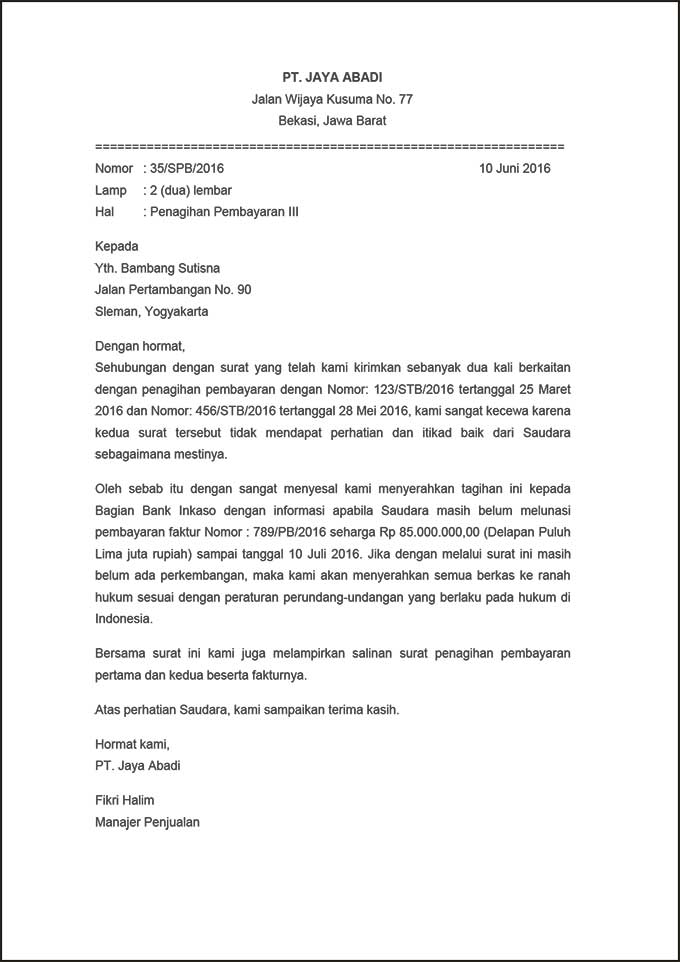

Sample Invoice

The main content of this Bill asks the buyer to pay off the debt immediately, besides that there are other things that must also be included, namely:

- That the buyer has not paid the debt

- Connect with mail order, delivery of goods and invoices

- Remind you that the due date has passed

- The outstanding amount owed

- It ends with the hope that the buyer will pay it within the deadline

For more details, see the example of a debt bill below.

Sample of Sewing Machine Payment Bill

Sample Company Bill

After that, you can move to the letter content. In the first paragraph, you can describe the amount of arrears that have not been paid. In that section, also include additional evidence for clarity, such as the invoice number that you made as additional explanation.

Also read: How to make a sample payment receipt

In the next paragraph, you can write about how long the arrears have been paid. After that, provide information about the extra due time given so that the collectible can get information about it and immediately pay off the arrears he has.

After that, in the last section convey greetings and a clear signature and name of the party sending this letter.

Debt Collection Success Tips

Debt that is paid off is better than debt that is not paid. Therefore regardless of whether you are providing debt as a favor or as an investment, of course you still expect your money back. Especially if the amount is relatively large, such as investment debt.

The following are tips for collecting debt that you can follow:

- Good communication between the two parties is necessary to reach a mutually beneficial agreement.

- Create a debt repayment schedule, so that progress can be measured in settlement of debts.

- Keep a neat record of the amount owed and the remaining balance and when the payment will be implemented.

Also read: How to Become a Successful Entrepreneur?

From the information above, of course you will know how to make a bill. Therefore, it is important for everyone to know about how to make it and how to charge it. I hope this information is helpful.