The break-even point is the equilibrium point where the total revenue equals the capital expended, resulting in neither profit nor loss.

How to determine the break-even point? To determine the break-even point, you need to use the formula BEP = fixed cost / (unit selling price – unit variable cost). For a complete explanation, read this article to the end, shall we?

What is Break-Even Point?

Before discussing how to determine the break-even point (BEP), it is essential to understand the overall concept related to BEP.

The break-even point is where the total value of revenue equals the amount of capital expended. At this point, the total losses are precisely at point 0 (zero), which means the company or business does not experience losses, but also does not make a profit.

Why Calculating BEP Is Important

As a business owner, you need to calculate BEP in detail. Because from the calculation of the Break-Even Point (BEP), you can find out how to gain profits or determine the break-even point for your newly established business.

Simply put, you will know if the business you run can make a profit when the sales volume exceeds the total fixed and variable costs that arise in the production process.

Conversely, if the business sales can only cover some of the fixed and variable costs, then undoubtedly your company will experience losses. The bigger the difference in figures, the greater the losses you will experience.

By the way, this BEP calculation is also widely used by stock traders. Usually, many stock market calculations use the BEP method when they want to buy or sell stocks.

By calculating BEP first, you can precisely determine the right time to make a call (buy) and when to put (sell).

Do you also want to calculate your own business’s BEP? In this digital era, there are applications available that can help you calculate BEP more easily. Even without the need to memorize the BEP formula. One of them is by using the iReap application.

Break-Even Point Concept & Basic Assumptions for Calculation BEP

To benefit from BEP and know how to calculate BEP correctly, you also need to understand the concept and basic assumptions of BEP. Here are some concepts and basic assumptions of BEP that you can use as a basis for calculation:

- All forms of costs incurred during the production or operational process of the business must be categorized into fixed costs and variable costs according to the applicable provisions.

- The nominal variable costs can change following the changes that occur during production. For example: changes in raw material costs due to an increase in production volume, production machine maintenance costs, etc. Meanwhile, the nominal fixed costs will remain the same even with changes in production volume. For example: factory rent costs.

- The total fixed costs will not change despite changes in production activities, but the fixed costs for each unit can vary.

- The selling price used for each unit must remain constant during the analysis period you are conducting.

- The number of products produced will always be considered as sold out and all sold out.

- The company can choose to manufacture and sell only one type of product. However, if it chooses to produce and sell more than one type of product, then the calculation must be done specifically for each product.

In essence, you need to understand well how the basic concept of BEP works. The goal is to make the break-even analysis constant, good, and accurate.

Benefits of Break-Even Point (BEP)

1. Facilitating Business Analysis

Calculating BEP allows you to analyze business profits and losses, even from the start of the production process.

So, when you start a business or plan to produce a product, calculate the break-even point first so that you know how much production volume needs to be generated with the production costs (fixed and variable costs) incurred.

The same applies to finding out how much sales volume you need to achieve for the business to make a profit.

2. Making Better Strategic Decisions

Essentially, the benefit of the break-even point for a company is to help business owners make better strategic decisions.

As a business owner, you will know when to make purchases, how much products to sell, and the next steps needed to achieve the predetermined business targets.

3. Helping to Maintain Business Growth

Another function of the Break-Even Point is to help companies maintain their existing growth.

This way, the company’s performance and finances will always remain in a constant or stable position during its business journey.

4. Accurate Data-Based Information

BEP helps you obtain as much information as possible about the investments that the company needs to make, in order to balance the expenses that occur during the initial implementation of the production process.

Even BEP plays a significant role when the company needs to buy or sell stocks or analyze the budget of a project to be carried out.

5. Facilitating Margin Determination

Calculating BEP in detail and accurately also helps you determine the appropriate margin. This becomes an effective step in setting clear boundaries and determining what needs to be done to minimize potential losses to a certain extent.

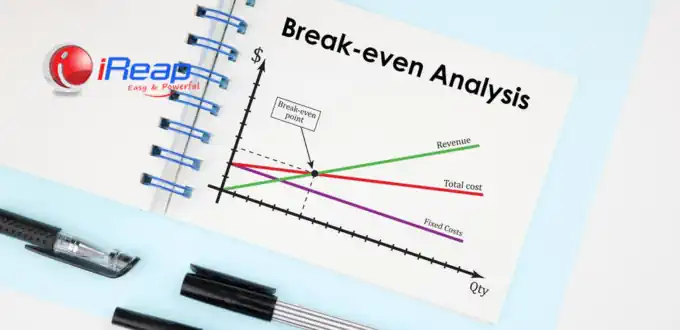

4 Components of BEP

Before further discussing what needs to be known in the break-even point formula, first understand the 4 components of BEP, namely:

- Fixed cost is the fixed cost or the amount of cost that will not change even if the produced volume can vary.

- Variable cost is the variable cost, and its value can change depending on the changes that occur within the production volume itself.

- Income or revenue is the amount of income received by the company.

- Profit is the net income amount, after the total income is reduced by fixed and variable costs.

BEP Formula

After knowing the basic components in BEP, the way to calculate the break-even point requires the BEP formula, which is:

BEP = Fixed cost / (Selling price per unit – Variable cost per unit)

With the formula for the unit selling price and unit variable cost being the formula for the contribution margin per unit or the formula:

BEP = Fixed Cost / Contribution margin for each unit

In calculating BEP in a specific currency amount, the formula is:

BEP in a specific currency = Selling price per unit x BEP for per unit

The formula to calculate and know the amount of this contribution margin is:

Contribution margin = Total sales – Variable cost

Break Even Point Example Question and Answer

To gain a deeper understanding of how to calculate BEP, study the following break-even point example:

You are an accountant for a company that oversees operations, production implementation, and goods provision. At the beginning of the production process, it is known that the company needs operational costs of 50 million Rupiah. The targeted profit is 20 million Rupiah. Here’s how to calculate the BEP correctly:

Total fixed costs = 50,000,000

Variable cost per unit = 30,000

Selling price per unit = 50,000

Targeted profit = 20,000,000

So, BEP is calculated using the following formula:

BEP = 50,000,000 / Existing Contribution Margin

BEP = 50,000,000 / (50,000 – 30,000)

BEP = 50,000,000 / 20,000

BEP = 2500 units

BEP in Rupiah = Selling price per unit x Number of BEP units

BEP in Rupiah = 50,000 x 2,500 units

BEP in Rupiah = RP 125,000,000.00

To ensure the BEP calculation you perform is accurate, practice regularly using several case studies.

Now, you have a complete understanding of what break-even point is, the BEP formula, and how to calculate BEP. Next, read and learn about the Analysis and Factors Affecting BEP.