Micro, Small, and Medium Enterprises—known as UMKM—are business entities operated by individuals, households, groups, or organizations. But how can you determine whether the business you are building qualifies as UMKM? Explore the comprehensive explanation of the latest 2021 UMKM criteria and their examples in this article.

Updates to UMKM Criteria under the Job Creation Act & Government Regulation No. 7 of 2021

In the past, the classification and criteria of UMKM were determined based on net worth and annual sales, as stated in the 2008 UMKM Law. However, these criteria were revised following the enactment of the Job Creation Act on February 2, 2023.

Since the explanations were not sufficiently detailed, the government issued approximately 49 implementing regulations to clarify provisions that were incomplete in Law No. 11 of 2020 concerning the Job Creation Act.

One of these is Government Regulation No. 7 of 2021 on the Facilitation, Protection, and Empowerment of Cooperatives and Micro, Small, and Medium Enterprises.

Within Government Regulation No. 7 of 2021, specifically Articles 35–36, UMKM classification is clearly based on business capital or annual sales.

Capital-based criteria apply to UMKM newly established after the regulation took effect. Meanwhile, annual sales criteria apply to UMKM that existed prior to the regulation.

Additionally, the regulation includes various policies related to ease of business establishment, licensing, facilitation, access to financing, supply chain integration, and market access for cooperatives and UMKM.

Three Updated UMKM Criteria Based on Government Regulation No. 7 of 2021

As previously explained, UMKM criteria under the regulation are determined by two aspects: business capital and annual sales. Based on Article 35 paragraph (3), the classifications are as follows:

1. Micro Enterprises

A micro enterprise is defined as a business with total capital of up to 1 billion Rupiah, excluding the value of land and buildings used for business operations.

2. Small Enterprises

If your business has capital ranging from 1 to 5 billion Rupiah, excluding land and building value, it falls under the small enterprise category.

3. Medium Enterprises

Medium enterprises are those with business capital between 5 and 10 billion Rupiah, also excluding land and building value.

To understand UMKM classification based on annual sales, continue reading the section below.

See also: Understanding UMKM Definitions and Criteria

UMKM Classification Based on Annual Sales

According to Article 35 paragraph (6) of Government Regulation No. 7/2021:

- Micro enterprises have annual revenue between 0 and 2 billion Rupiah.

- Small enterprises report annual sales between 2 and 15 billion Rupiah.

- Medium enterprises generate annual revenue ranging from 15 to 50 billion Rupiah.

Government Regulation No. 7 of 2021 does not only define UMKM criteria based on capital and revenue—additional parameters may also apply.

For example, Article 36 paragraph (1) allows ministries or institutions to apply criteria such as revenue, net worth, investment value, number of employees, incentives/disincentives, local content, or environmentally friendly technologies, depending on sector-specific requirements.

Such criteria may only be applied by technical ministers or institutional leaders after receiving consideration from the Minister of Cooperatives and SMEs.

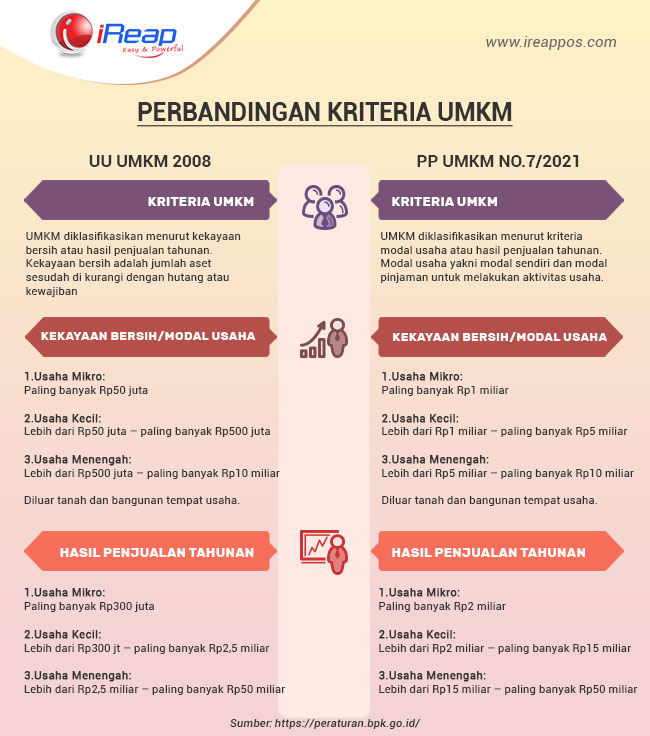

Differences Between UMKM Criteria in Government Regulation No. 7 of 2021 and the 2008 UMKM Law

To understand how UMKM regulations evolved from the 2008 UMKM Law to the updated criteria in Government Regulation No. 7 of 2021 as outlined in Article 6, refer to the comparison infographic below:

Latest UMKM Criteria Comparison

As a business owner, understanding regulatory developments related to your enterprise is essential—including staying informed about the latest UMKM criteria. Download the full Government Regulation on the Facilitation, Protection, and Empowerment of Cooperatives and UMKM here:

Download PP Nomor 7 Tahun 2021.pdf.

Also ensure you understand the mandatory legal documents required for your business operations, such as the Business Location Permit and Halal Certification.