The cost of goods sold or COGS is the purchase price of an item or the cost of producing a thing that the businessperson will sell later. For example, all expenses incurred to obtain merchandise and often referred to as the price of capital.

What does COGS consist of? Generally, the Cost of Goods Sold (COGS) consists of raw material costs, labor costs, distribution costs (transportation to obtain goods), and overhead costs. To clarify the meaning of COGS, the purpose of calculating it, its components, and examples, read this article until it’s finished.

COGS is …

COGS stands for Cost of Goods Sold. COGS is the amount of money you spend to acquire merchandise, either directly or indirectly, and determines the item’s capital price.

For example, you wholesale merchandise at wholesale prices. Then to get the goods, there are transportation, freight, and packaging costs, for example.

Another example you bring merchandise from abroad to be sold domestically. The costs you incur to bring in the goods include product prices, import costs, assembly costs, packaging costs, shipping, and other costs. You have to calculate all of these costs to determine the COGS.

Reasons Why You Need to Calculate COGS

You need to calculate the Cost of Goods Sold (COGS) because this price determines how much the actual price of a product.

After knowing, then you can determine the profit or profit value that you want to get. In other words, here are the benefits of calculating the COGS price:

- You will know the capital price of the merchandise.

- To determine the selling price of the product according to the target market. Not expensive and not cheap.

- Easy in calculating Gross Profit Margin or gross profit margin. How to calculate GPM: subtract income with COGS, then divide the result by total income.

- So you can evaluate the costs incurred. Which costs are directly related to the product and which are indirect.

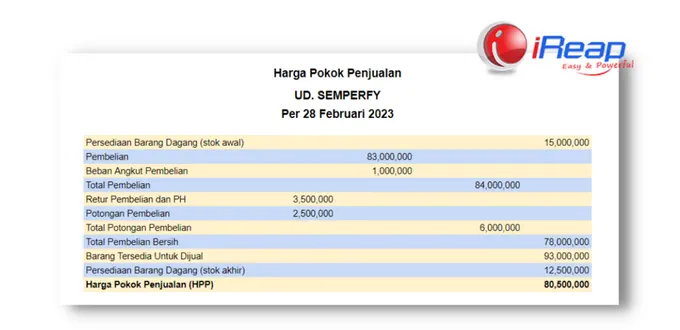

Cost of Goods Sold (COGS) Components

1. Beginning Inventory or Beginning Stock of Goods

Initial inventory is the total number of items still available in stock at the beginning of a certain period before adding new items.

2. Purchase of Goods or Addition of Merchandise

You must purchase goods or add merchandise to ensure stock items are available.

In the COGS calculation, the purchase of goods must include all costs associated with merchandise, including transportation costs, discounts, price discounts, and even goods returns, if any.

3. Ending Inventory

Ending inventory is the total amount after the addition or purchase of goods. How to calculate it: topping list = beginning inventory + purchases/additions to stock.

Easy Ways to Manage Goods Stock

When you need to calculate COGS, you must know the initial stock and the final stock available. Of course, it will be very inconvenient to do a stock count or take inventory first. Then an easy way to manage merchandise stock you can use iReap POS. You can read an explanation about iReap POS here: iReap POS features.

Example of Cost of Goods Sold